How often do we interchange two words that seem to have the same meaning and get away with it? In accounting, especially, some terms can get very confusing because of the similarities they possess. Two such concepts are an “invoice” and a “bill”.

In business organizations, invoices and bills are frequently used in place of the other, because of the resemblance they hold. These documents are like two peas of the same pod.

But despite them being similar, many characteristics differentiate them from each other.

Invoices are an important medium for buyer-seller relationships. To know more about billing and invoicing and their differences, keep reading the article.

What Is A Bill?

A bill is issued by a business, mentioning the amount the customer owes for the goods or services they have received. It documents evidence of one party’s indebtedness to the other.

Some of the main characteristics of a bill are:

- It is given to the customer before the payment is made

- It contains the transaction between two parties for the products received or services rendered.

- It must also include an order to pay.

- It should be signed by both the buyer and seller.

Billing is most commonly used for retail businesses, like restaurants, grocery stores, supermarkets, and merchandise stores.

What Is An Invoice?

Source:academy.getjobber.com

An invoice is a cost breakdown submitted by the provider of a product or service to the customer. The invoice lists and outlines everything provided, as well as the obligation and date for the payment to be made.

The main features of an invoice are:

- It is used in business transactions where payment is required by a customer for services rendered.

- It is issued prior to the amount received and to request it by a specific date.

- It is a record of the products or services provided by the business for bookkeeping purposes.

- It is legal documentation of business transactions.

- It notifies about all the goods and services offered, the amount of money due for the service, and the contact information for both the supplier and the buyer.

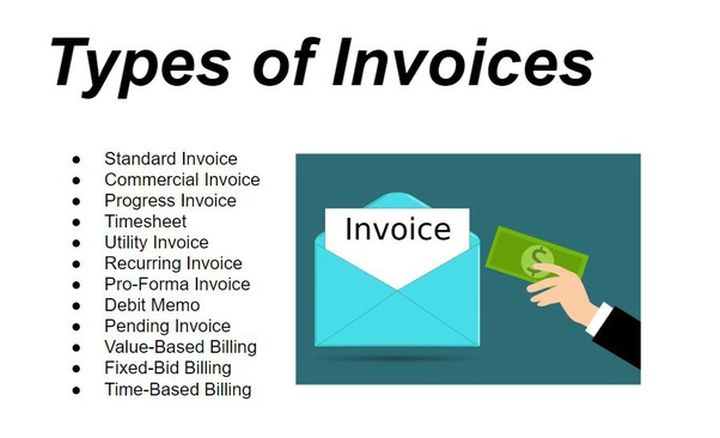

Types of Invoice

Source:smartadmin.co.in

Based on its various functions, invoices are divided into categories. Some of the most common invoices used by businesses are:

Standard Sales Invoice

When an invoice is issued by a company to a buyer, it is known as standard sales invoice. It is commonly used by small companies, and the style is adaptable to most sectors and billing periods.

Credit Invoice

Businesses issue a credit memo to rectify a former calculation mistake for purchase orders, provide refunds to a vendor, or give a discount to their clients. A credit invoice should have a negative balance.

Source:bizfluent.com

Debit Invoice

Firms that need to add to the amount owed by a consumer issue a debit memo. Small companies use debit invoices when a minor update to a bill is needed. A debit invoice should have a positive total balance.

Commercial Invoice

When a company sells products or services internationally based on purchase orders, it creates a commercial invoice. It contains transaction details that are required for the clearance of shipments at borders.

Timesheet Invoice

Source:zoho.com

When a company or worker is billed depending on the number of working hours and their rate of remuneration, a timesheet invoice is used. Contract employees like therapists, lawyers, and consultants, who are working on an hourly basis use timesheets.

Expense Reports

Expense reports are tools that document the money a business spends. It is most typically used for employees to itemize expenses on which they are awaiting reimbursement. If your employees incur business expenses, such as traveling to a meeting, visiting clients, or driving their personal car to work, you will document such expenditures in an expense report.

Billing Vs Invoicing- What Is The Difference?

Source:debitoor.com

While the two business documents can seem very similar, they are different based on their purpose and components.

Purpose of billing and invoicing

Both bills and invoices are used for the same purpose, which is documenting the transaction between a seller and a buyer.

Bills, however, are used by retail businesses for one-time payments that have to be made upfront. On the other hand, invoices can either be one-time or recurring, depending on the type of invoice issued. Businesses do not send bills, but invoices for goods and services sold on credit.

If you eat at a restaurant, buy a pair of shoes at a store, or get a haircut, you will be issued a bill that has to be paid then and there. Whereas, if you hire a wedding planner or a web developer, you will be sent an invoice that mentions the date of payment.

Components of bills and invoices

Source:investopedia.com

A bill usually contains limited details. There is no information provided about the customer. Since bills are an up-front payment for retail services, they only contain the necessary information about the goods and services rendered.

Bills are mostly not numbered, but if they are, it is for the company’s administrative records. But every invoice has to be given a unique number, as it is used for financial reporting, tax purposes, and accounting.

An invoice on the other hand is a detailed document. It includes the following components:

- The header with the word “invoice”

- Business contact details

- Customer contact details

- Unique reference number

- The date when it was issued

- Description of the purpose of the invoice

- Taxes and additional fees

- Balance due

- Terms and Conditions of the business

With online invoice generators like my.billdu.com, you can create professional and accurate invoices for your business in no time, from the convenience of your smartphones! And the best part? It is free!

Can One Document Be Both?

Though the terminologies and definitions of both invoices and bills differ, only in very few cases are they interchangeable.

As mentioned earlier, invoices are more detailed and typically issued for future payments. But if a person purchases a product from a store that accepts future payments, they can be invoiced or billed for the same.

But for everyday use and purchases of a smaller level, billing is a common accounting method whereas invoices are often for business transactions.

Conclusion

Now that you have understood how different bills and invoices are, you will be able to tell one from the other easily! Bills and documents are essentially created for the same purpose but are used for different types of transactions. You can save your time and money by using invoicing software to create your invoices!